food tax in maryland

The program was originally launched exclusively in Southern Maryland and Montgomery County but was expanded statewide and will now continue through 2021 following the passage of. What Is Tax Free In Maryland.

How To Maximize The Benefits Of Donating To A Charity Annapolis Md Estate Planning Attorneys

Is the food taxed here in Maryland.

. 1-888-373-7888 233733 More Information on human trafficking in Maryland Customer Service Promise The State of Maryland pledges to provide constituents businesses customers and stakeholders with friendly and courteous timely and responsive accurate and consistent accessible and convenient and truthful and transparent services. Please visit our Locations page to schedule an in-person or virtual appointment. LicenseSuite is the fastest and easiest way to get your Maryland foodbeverage tax.

Made by a cottage food business that is not subject to Marylands food safety regulations It is our intention that each approving authority will enforce and regulate these business consistently and uniformly as stated in the regulations. In general sales of food are subject to sales and use tax unless the food is sold for consumption off the premises by a person operating a substantial grocery or. Maryland Department of Health - Coronavirus Disease 2019 COVID-19 Information.

This page describes the taxability of food and meals in Maryland including catering and grocery food. The states tax-free week is from Aug. Due to a 2012 law change for sales made on and after July 1 2012 charges for alcoholic beverages are subject to tax at the 9 rate and charges for mandatory gratuities are subject to the 6 rate regardless of whether the gratuities relate to sales of alcoholic beverages or sales of food and non-alcoholic beverages.

An interesting development in 2013 state legislation was Marylands passage of SB 820 which imposes a fee on pet food to fund a statewide spay-neuter program aimed at low-income communities. Sale of food that is exempt from the state sales and use tax Under Section 11-206 of the Tax-General Article of the Annotated Code of Maryland. Temporary Sales and Use Licenses.

Comptroller of Maryland branch locations are accepting appointments. Sales and Use Tax. Posted by 1 year ago.

Most staple grocery items and cold prepared foods packaged for home. How is food taxed. If you need any assistance please contact us.

However vehicle rentals and the sale of alcoholic beverages are taxed at different rates. Exemptions to the Maryland sales tax will vary by state. Sales Tax Rate for Food and Personal Hygiene Products Sales of food for home consumption and certain essential personal hygiene products are taxed at the reduced rate of 25 throughout Virginia.

For example if I go grocery shopping will there be a tax rate. To obtain a temporary license call 410-767-1543 or 410-767-1531. The Maryland Food Donation Pilot Program was signed into law by Governor Larry Hogan in 2017It allows farmers to donate eligible food in return for a tax credit against State income taxes.

To learn more see a full list of taxable and tax-exempt items in Maryland. Information About Sales of Food. Does anyone know what items arent taxed here in MD.

State sales taxes apply to purchases made in Maryland while the use tax refers to the tax on goods purchased out of state. In some states items like alcohol and prepared food including restaurant meals and some premade supermarket items are charged at a higher sales tax rate. Car and recreational vehicle rentals are taxed at 115.

Beginning January 1 2023 the rate will decrease to 1. For example if I go grocery shopping will there be a tax rate. Discounted merchandise is also tax-free and coupons can be used as long as theyre issued from the.

A 6 tax rate applies to most goods and services. The Maryland sales tax rate is 6 as of 2022 and no local sales tax is collected in addition to the MD state tax. Read the Law.

By Eduardo Peters August 15 2022 August 15 2022. Any piece of clothing or footwear under 100 will be exempt from the states sales tax. Every state that has a sales tax also has a use tax on the purchase of goods and services as defined by law.

Code Tax-General 11-101 m Rates - Maryland taxes various goods and services at different rates. The MD sales. Despite opposition from the pet food industry the amended bill passed overwhelmingly in both houses of the Maryland legislature.

In general sales of food are subject to sales and use tax unless a person operating a substantial grocery or market business sells the food for consumption off the premises and is not a taxable prepared food. This includes the sale for consumption off the premises of crabs and seafood that are not prepared for immediate consumption. Food Tax In Maryland.

Sale of food or beverage from a vending machine. Please note that the sample list below is for illustration purposes only and may contain licenses that are not currently imposed by the jurisdiction shown. Is the food taxed here in Maryland.

Is the food taxed here in Maryland. Businesses in Maryland are required to collect Marylands 6 percent sales tax and or 9 percent. Business tax tip 5 How are Sales of Food Taxed in Maryland.

Please sign up below to receive news releases and tax bulletins with important information from the agency. Individuals who do not have a permanent sales tax license are required to obtain a temporary license and collect a 6 percent or 9 percent sales and use tax for sales at various events such as craft shows and fairs. California 1 Utah 125 and Virginia 1.

A grocery or market business is considered substantial if sales of grocery or market food items total. While Marylands sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. What qualifies as food for home consumption.

Our Fogodechao Benefit Dinner Soldout In Only A Few Days Special Thanks To Everyone Who Made A Rese Junior Achievement Financial Literacy Family Night

Maryland Food Stamps Eligibility Guide Food Stamps Ebt

9 Best Places To Eat In Maryland Chaps Pit Beef Places To Eat Pit Beef Best Places To Eat

Pin By Jo Taylor On Maryland Hon Food Maryland Beef

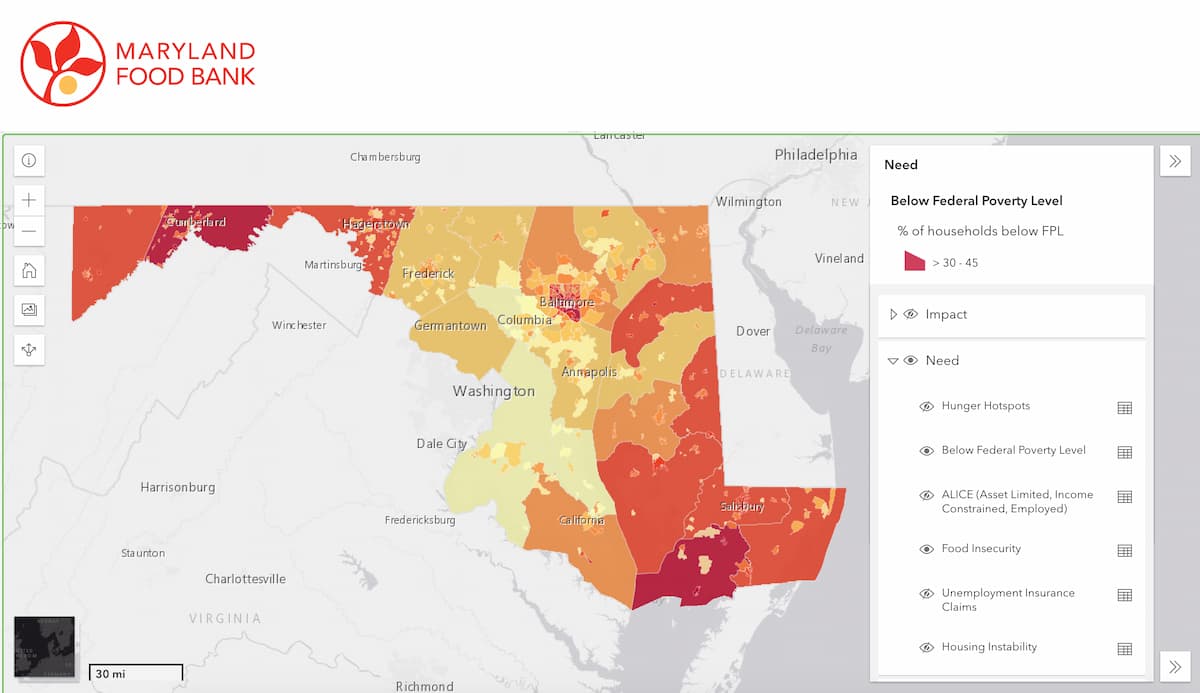

Research And Reports Maryland Food Bank

Auction To Raise Money For A Thanksgiving Dinner Fund For Families In Need How To Raise Money Thanksgiving Baskets Silent Auction

Tersiguels Restaurant In Ellicott City Ellicott City Maryland Ellicott City Ellicott City Md

Maryland Agriculture Has It All Usda

Maryland State Drink Milk State Foods Food Drinks

Champagnes Cafe Champagne Cafe Fine Food

Maryland Crab Dip With Breadsticks Maryland Crab Dip Crab Recipes Crab Dip

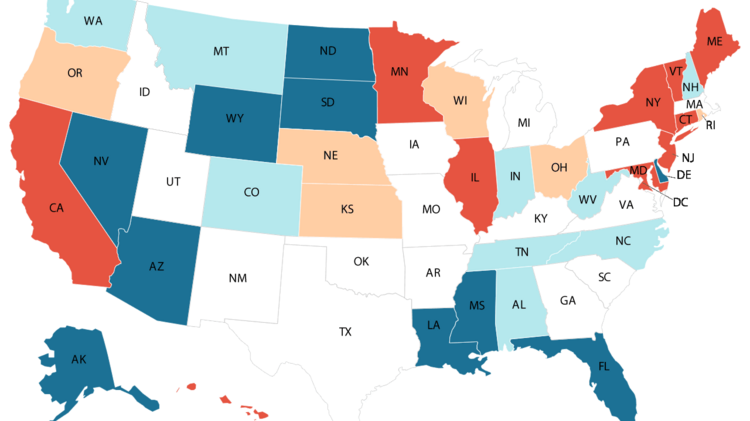

Maryland Named No 2 Least Tax Friendly State By Kiplinger Baltimore Business Journal

Food Mom Pop Pizza Subs California Maryland Pizza Wings

Maryland Sales Tax Guide And Calculator 2022 Taxjar